It's Time to Build in Europe

Build in Europe is more than just a new content series – it's a call to action.

Our goal? To have the difficult, but necessary, conversations that address Europe-wide fragmentation and pave the way for the continent's long-term success.

We've just launched our initial thesis, highlighting what we see as a generational opportunity in European tech.

Europe's strengths are undeniable: world-class universities, deep scientific expertise, and ambitious founders. Still, we continue to underperform in scaling startups, attracting top global talent, and leading in frontier technologies such as AI, defense, and deep tech. Over the next few months, we'll be releasing content on crucial topics like talent, capital, and regulation.

Join us as we aim to reshape the conversation around Europe's tech future.

What else is happening...

→ Have You Heard? Our portfolio companies announced more than €100 million in follow-on funding in the past month.

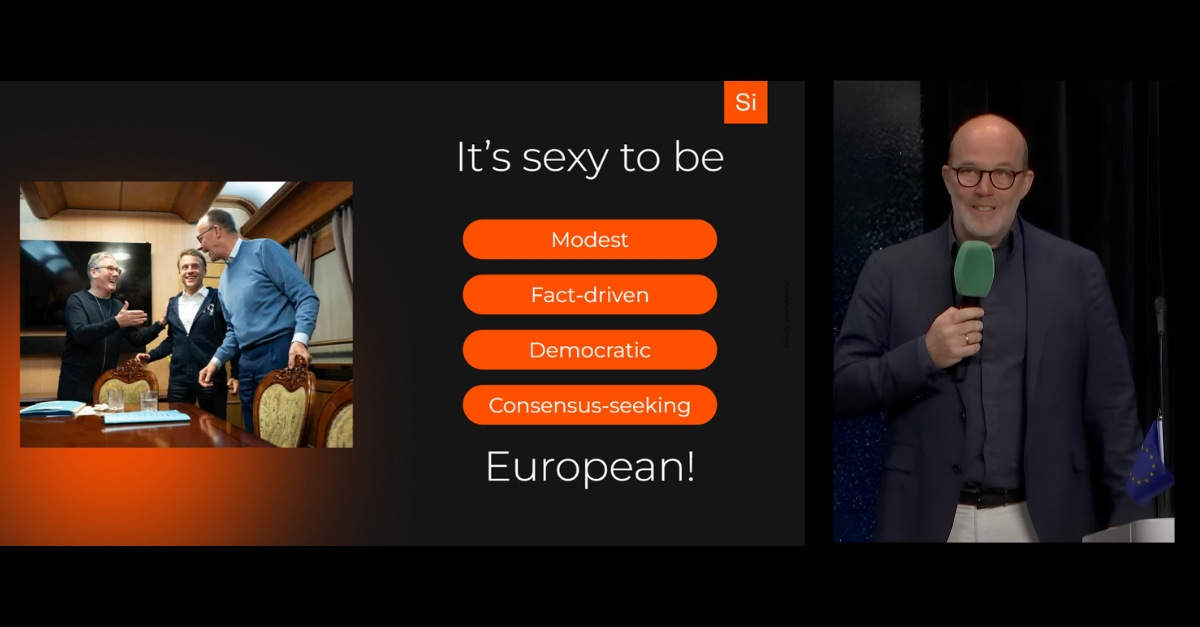

→ Our Perspective: Our CEO, Oliver Holle, talked Trump, VC AuM, and Europe's geopolitical alliances in a recent keynote speech.

→ Speedinvest News: We announced our Fund-of-Funds investment in Meridian Health Ventures & were named one of the top 10 most active backers of startups in the DACH and CEE regions by Sifted.

Additional portfolio updates, deep-dive content, job openings, and more below ⬇️

Want even more founder-focused insights delivered to your inbox every month? Click the image below to subscribe to our new "Scaling at Speed" newsletter.

Have You Heard?

Our portfolio's latest announcements

Seqera raises a $26 million Series B to power the future of bioinformatics and life science R&D.

The Barcelona-based company is at the forefront of making scientific workflows more scalable, reproducible, and collaborative. The Series B, led by Addition, with participation from Speedinvest, Talis Capital, Amino Collective, BoxOne Ventures, and SNR, will enhance solutions enabling a new era of discovery at the intersection of biology, data science, and engineering.

Read more from Seqera co-founder & CEO, Evan Floden, here.

- Berlin's Trawa has raised €24 million in Series A funding in a round led by Headline. Trawa is a renewable energy supplier that helps to simplify energy purchasing and management for SMES using AI. Silicon Canals has more.

- London-based Breathe Battery Technologies has secured a $21 million Series B funding round, led by Kinnevik with participation from Lowercarbon Capital and Volvo Cars Tech Fund, to advance its battery intelligence software. Breathe optimizes battery development for cost, performance, risk, flexibility, and influence, reducing charging times through real-time adaptive charging without requiring battery design changes or extra raw materials. TechCrunch has more.

- Munich-based Remberg has secured €15 million in a Series A+ funding round to fuel the company's expansion across Europe. The new funding, from Oxx and Action Capital, will help enhance its AI-powered maintenance platform, which helps industrial companies prevent costly unplanned machine downtime. Read more in FAZ (German) and EU Startups.

- London-based Stotles has raised a €11.5 million Series A funding round to expand into the US market and further develop its platform. The company offers a platform that helps private sector suppliers grow their revenue in the public sector. EU Startups has the details.

- Riverse has raised €5 million in new funding in a round led by Alven and Racine2. Founded in Paris in 2022, Rivese provides a carbon crediting standard and platform for engineered climate solutions, and will use the new capital to grow this platform for businesses. Read more on Tech.eu and Maddyness.

Welcome to the Family

SpAItial AI, a spinout of TU Munich, wants to redefine spatial-native generative AI.

Founded by a world-class team, including Matthias Niessner, cofounder of AI unicorn Synthesia, SpAItial will build out Spatial Foundation Models (SFMs) that interpret the world through location and spatial data, similar to LLMs and natural language processing. TechCrunch and Handelsblatt have the details.

- We’re excited to back Copenhagen-based Paradox, a company rethinking organizational design from first principles and building the structural intelligence layer modern companies desperately need. Read more about why we invested here.

- Scalera, a spinout from Zurich-based university ETH, is transforming construction procurement with AI, addressing inefficiencies in the $13T global market. By automating tender parsing, supplier matching, and bid generation, Scalera cuts days of manual work into hours. Business Insider has more.

Portfolio Headlines & Highlights

News and updates from across our portfolio

- Bitpanda is partnering with Aircash, Croatia’s leading fintech, to let its customers invest in cryptocurrencies.

- Kittl is highlighted by XDA-Developers as a go-to alternative to Adobe Illustrator.

- Fernride is showcased by ZDF Heute for playing a key role in Munich's drive to establish itself as Germany's AI capital.

- Emmi AI cofounder, Johannes Brandstetter, one of the driving forces behind weather forecasting AI Aurora, is highlighted by Microsoft CEO Satya Nadella.

- Curve has the first wallet in EEA to compete with Apple on iOS with Curve Pay.

- Hexafarms is one of 15 Berlin-based companies vying for the city's 2025 Deep Tech Awards for their use of AI to optimize commercial food production.

- One Trading is now MiCAR-approved and can offer crypto spot trading and custody in the EU.

- Billie is the first B2B Pay Later solution to become generally available on Stripe.

Our Perspective

Sector-focused expertise and insights on the VC ecosystem at large

- Our CEO & Managing Partner, Oliver Holle, was the keynote speaker at this year's EUVC Summit in London. You can read the main takeaways from his speech, plus his podcast appearance, on the Speedinvest blog. Tech.eu also summarised some of the headlines from Oliver's speech.

- GP Marie-Helene Ametsreiter spoke with Handelsblatt about the liquidity gap in VC and how our DPI team is creating innovative solutions that benefit both our startups and LPs.

- GP Markus Lang was part of an invest.austria panel discussing Austria's new Red-White-Red Fund of Funds, as the country looks to continue to push for innovation in capital markets.

- Our Partner Tom Filip Lesche spoke to Pitchbook about European fintech's re-emergence and the possibility of an improved environment for M&A.

Who's Hiring?

There are more than 1,000 vacancies across our portfolio. Browse open jobs below and on our website.

- Gigs: Implementation Manager – New York

- Billie: Credit Portfolio Analyst – Berlin

- Bitpanda: Python Engineer, Asset Pricing & Hedging – Vienna

- Autone: Account Executive – New York

- trawa: Partnership Manager – Berlin

Sign up for our exclusive talent pool!

With nearly 300 portfolio companies, Speedinvest has become one of the largest networks in the European startup scene. Join our exclusive talent pool to find your next career move, receive top news, and connect with founders directly.

Join the Speedinvest Team

Our team is always on the lookout for top-tier talent. Check out our featured roles below.

- Associate, SaaS & Infra: Munich, Paris, or Berlin.

- Governance, Risk & Compliance Lead: Vienna

- FP&A Analyst: Vienna

- Analyst, Marketplaces & Consumer: Munich, Berlin, or Paris

See you next month!